Article Mention: The content of post is dependant on the new author’s views and you will information by yourself. It may not had been analyzed, accredited or else supported because of the any kind of the community lovers.

Military borrowers having bumps within their credit history may find it smoother than just they feel locate approved to possess a Virtual assistant house mortgage that have bad credit. Accepting certain energetic-duty and you can resigned provider participants face financial demands that civilians try not to, the latest U.S. Agencies from Experts Items (VA) might make certain mortgages getting experts which have big credit troubles, including bankruptcies and property foreclosure.

- Is it possible to get a great Virtual assistant mortgage with less than perfect credit?

- Sorts of Virtual assistant loans you can aquire which have bad credit

- Just how Virtual assistant bad credit fund compare to other financing applications

- Virtual assistant money along with your CAIVRS history

Can i get a good Va loan that have bad credit?

The easy respond to: sure. Virtual assistant advice had been constructed with the brand new special demands out-of army consumers at heart. New disruption out of handle deployments and you can getting used to civil lives once active-obligations service can occasionally cause a lot more monetary complications for military parents.

- Zero minimum credit score. There’s absolutely no lowest credit rating lay of the Virtual assistant, many loan providers need an effective 620 lowest rating. Although not, the final one year out of payment records try scrutinized closely, especially their rent otherwise home loan repayments. You are able to beat a dismal credit payment records having causes or proof of active-responsibility deployments or disability-associated health challenges.

- 2-season wishing period shortly after a chapter seven bankruptcy proceeding. The newest Virtual assistant was sensitive to solution-relevant issues that can result in case of bankruptcy filings. Military individuals have to waiting merely 2 yrs off their bankruptcy release day to try to get yet another Virtual assistant financing (weighed against few years to have a normal loan).

- 12 months from payments on a chapter 13 bankruptcy otherwise borrowing from the bank guidance. Va borrowers who possess made 12 on-day monthly obligations as an element of a section 13 case of bankruptcy otherwise borrowing from the bank guidance program can get qualify for another type of Virtual assistant loan.

- 2-season prepared period just after a foreclosures. Military borrowers who lost a house in order to foreclosure qualify for a beneficial Va financing once 2 years article-closing.

- Virtual assistant foreclosures autonomy. Virtual assistant consumers may take aside another type of Virtual assistant financing, even after good foreclosed Virtual assistant financing on the certificate regarding eligibility. When you have enough Virtual assistant entitlement remaining, you’re in a position to get another type of house with zero down-payment.

Sort of Virtual assistant financing you can aquire with poor credit

Whether your make an application for that loan having bad credit in order to re-finance or purchase a house, the Virtual assistant credit standards are basically the same. Available Virtual assistant financing designs tend to be:

Virtual assistant get finance . Va borrowers to acquire property which have less than perfect credit is qualified with no down-payment and no home loan insurance (a form of insurance billed of many home loans if you create less than a good 20% deposit). In case your credit scores was low, loan providers pays attention to exactly how you reduced your rent or other expense in earlier times 12 months.

Va cash-aside re-finance money. Property owners can use good Virtual assistant financing in order to use up to 90% of their residence’s well worth, tapping even more guarantee to switch their residence otherwise repay large-desire borrowing from the bank profile. An advantage: Paying off handmade cards having a beneficial Va bucks-aside refinance you can expect to boost your ratings so that you don’t require an effective poor credit mortgage down the road.

Va rate of interest avoidance refinance financing (IRRRLs). Individuals that have a current Va loan only need to prove they have made the costs on time for the past 1 year to get entitled to an excellent Virtual assistant IRRRL. Domestic appraisals and you will income data files are not requisite, and you can settlement costs are going to be rolling toward amount borrowed. Even though you were thirty days later toward a recently available home http://paydayloansconnecticut.com/lakes-west/ loan payment, your lender may still agree a keen IRRRL by distribution your loan directly to the new Virtual assistant for acceptance.

Special notice throughout the Virtual assistant closing costs and you can poor credit

The reduced your credit score, the greater the risk you will find that you could default with the the loan. Lenders evaluate that it risk from the charging a higher rate of interest. This may make getting a good Va loan which have bad credit a great deal more challenging for two explanations:

Lender closing costs are capped during the step 1% of your loan amount. Whether your interest comes with write off points on account of an effective lowest credit rating, the full will cost you get exceed VA’s step 1% restrict toward full financial costs. In that case, you might not qualify for Virtual assistant financial support.

Virtual assistant refinance funds need a good 36-month breakeven towards the settlement costs. So you’re able to qualify for a Virtual assistant re-finance, the lender need certainly to confirm it is possible to recover your closing costs inside thirty six days, known as the break-even point. Breakeven are computed of the breaking up the total costs because of the month-to-month savings. When the highest discount points analyzed on account of less than perfect credit put you beyond this time around frame, you do not qualify for good Virtual assistant refinance.

Just how Virtual assistant less than perfect credit loans compare to other mortgage software

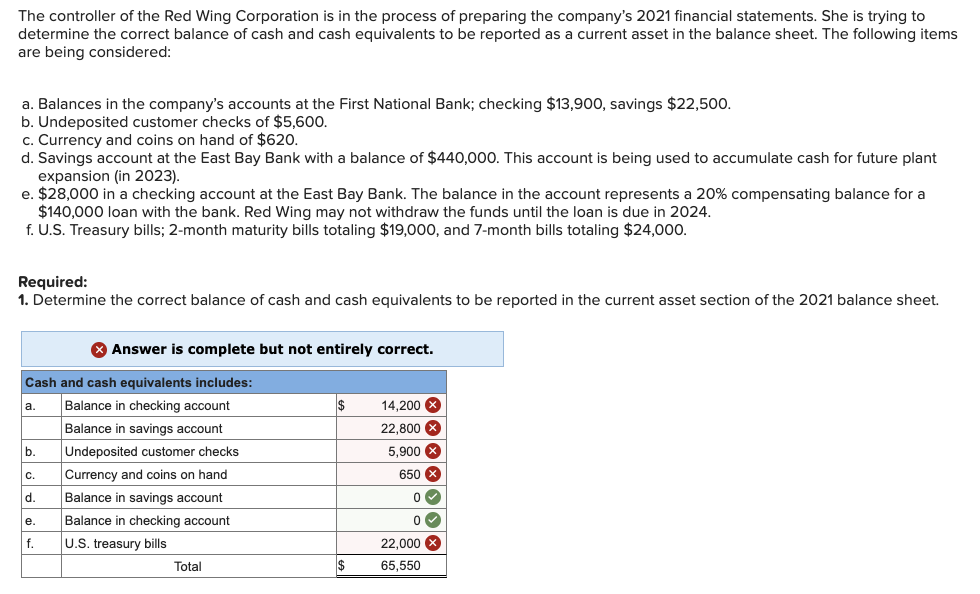

The brand new dining table lower than shows the distinctions inside the Va borrowing from the bank criteria rather than most other prominent home loan software, instance old-fashioned loans, FHA loans insured by the Federal Property Government and you will USDA fund backed by the latest U.S. Service off Agriculture:

Va fund plus CAIVRS history

The credit Alert Interactive Verification Reporting System (CAIVRS) was a database loan providers used to seek out people non-payments into federally assisted loans. All the details is actually gathered centered on overpayments getting studies experts, impairment positives otherwise Va foreclosures states.

You have got a hard time taking approved getting a government-supported financial in the event the CAIVRS history isn’t clear. not, Va loan providers could probably generate a difference if an effective outstanding membership has been put latest, or you have made to your-time repayments included in an installment arrangement.